VA Home Loans: Streamlining the Home Buying Refine for Military Worker

The Crucial Overview to Home Loans: Opening the Advantages of Flexible Financing Options for Your Desire Home

Navigating the complexities of home loans can commonly really feel challenging, yet understanding versatile funding alternatives is important for prospective home owners. With a variety of funding kinds available, including government-backed options and adjustable-rate mortgages, debtors can customize their funding to straighten with their individual monetary situations. These versatile choices not just give reduced first payments but may also provide distinct benefits that improve availability to homeownership. As you take into consideration the myriad of selections, one must ask: what factors should be prioritized to guarantee the finest suitable for your monetary future?

Recognizing Home Loans

Understanding mortgage is necessary for potential property owners, as they stand for a substantial monetary commitment that can influence one's monetary health for several years to find. A mortgage, or mortgage, is a kind of financial obligation that allows people to borrow cash to buy a home, with the building itself functioning as collateral. The lending institution offers the funds, and the consumer concurs to repay the loan quantity, plus interest, over a specified period.

Secret components of home mortgage include the major amount, rates of interest, car loan term, and monthly settlements. The principal is the original loan amount, while the interest price identifies the price of borrowing. Lending terms commonly range from 15 to three decades, influencing both monthly payments and general passion paid.

Kinds of Flexible Financing

Adaptable financing alternatives play a crucial function in accommodating the varied requirements of homebuyers, allowing them to tailor their home mortgage services to fit their economic scenarios. One of the most widespread sorts of versatile financing is the adjustable-rate mortgage (ARM), which offers a first fixed-rate period followed by variable prices that change based on market problems. This can give reduced initial settlements, attracting those who anticipate earnings growth or strategy to move before prices change.

Another choice is the interest-only home loan, permitting debtors to pay just the interest for a specific period. This can lead to reduced monthly settlements initially, making homeownership a lot more available, although it might lead to larger settlements later.

Furthermore, there are also hybrid loans, which integrate features of repaired and variable-rate mortgages, offering security for a set term followed by adjustments.

Finally, government-backed financings, such as FHA and VA lendings, use adaptable terms and reduced deposit requirements, catering to newbie customers and experts. Each of these alternatives presents unique benefits, enabling property buyers to choose a funding service that aligns with their long-term financial goals and personal circumstances.

Benefits of Adjustable-Rate Mortgages

Exactly how can variable-rate mortgages (ARMs) benefit buyers seeking cost effective financing choices? ARMs use the possibility for lower preliminary passion rates contrasted to fixed-rate home mortgages, making them an appealing option for customers aiming to reduce their regular monthly repayments in the very early years of homeownership. This first duration of reduced prices can significantly improve cost, permitting buyers to spend the financial savings in various other top priorities, such as home improvements or savings.

Additionally, ARMs frequently include a cap structure that limits just how much the rates of interest Recommended Site can boost during modification periods, offering a level of predictability and protection against extreme changes in the market. This feature can be especially helpful in a climbing interest rate atmosphere.

In Addition, ARMs are perfect for purchasers that intend to sell or refinance prior to the funding readjusts, allowing them to maximize the lower rates without exposure to potential price rises. Because of this, ARMs can offer as a critical financial tool for those that fit with a degree of threat and are wanting to optimize their buying power in the existing real estate market. Generally, ARMs can be a compelling choice for savvy homebuyers looking for versatile funding options.

Government-Backed Finance Choices

FHA fundings, guaranteed by the Federal Real Estate Management, are perfect for novice property buyers and those with reduced credit history. They generally require a lower down repayment, making them a prominent option for those who might battle to conserve a substantial quantity for a conventional funding.

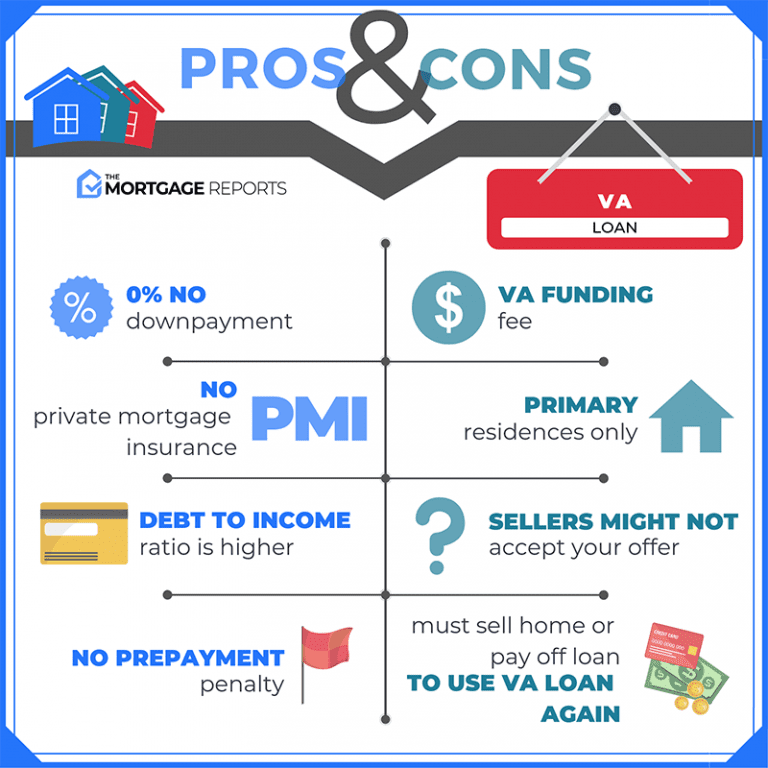

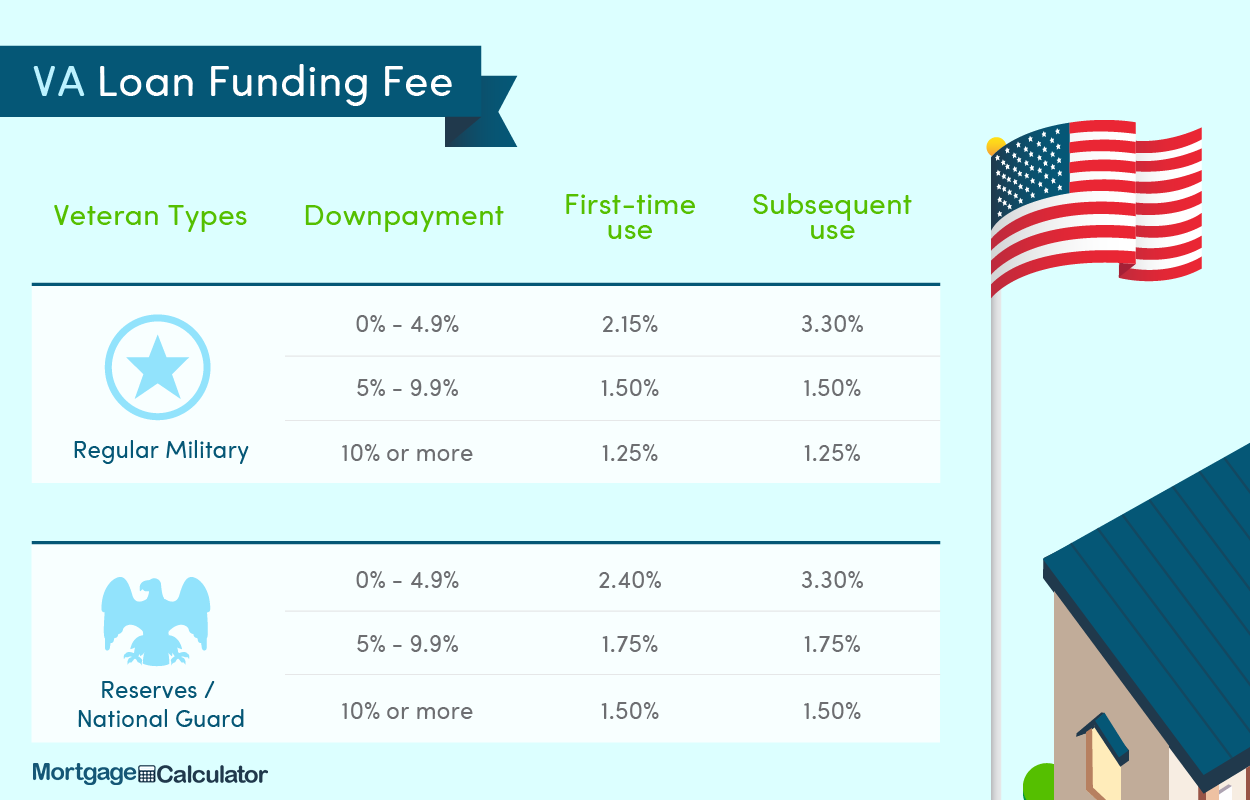

VA financings, offered to professionals and active-duty military employees, provide positive terms, consisting of no personal home mortgage and no down settlement insurance policy (PMI) This makes them an eye-catching alternative for eligible debtors wanting to buy a home without the concern of added costs.

Tips for Picking the Right Financing

When reviewing loan options, consumers usually take advantage of extensively evaluating their monetary scenario and lasting goals. Start by identifying your budget plan, that includes not only the home purchase cost but likewise extra prices such as real estate tax, insurance, and upkeep (VA Home Loans). This thorough understanding will certainly assist you in picking a loan that fits your financial landscape

Next, consider the sorts of lendings readily available. Fixed-rate home mortgages offer security in monthly payments, while adjustable-rate home Visit Your URL loans may provide reduced preliminary rates but can change over time. Analyze your threat tolerance and for how long you prepare to remain in the home, as these variables will certainly affect your car loan option.

In addition, inspect rates of interest and costs related to each financing. A reduced rates of interest can considerably decrease the complete expense with time, but bear in mind closing expenses and other costs that might counter these cost savings.

Verdict

In verdict, navigating the landscape of mortgage reveals numerous versatile financing alternatives that accommodate diverse consumer requirements. Understanding the ins and outs of numerous funding types, including variable-rate mortgages and government-backed fundings, allows notified decision-making. The benefits offered by these funding methods, such as lower first repayments and customized benefits, eventually boost homeownership access. A complete assessment of offered options makes sure that potential homeowners can protect the most suitable funding remedy for their special monetary scenarios.

Navigating the intricacies of home loans can frequently really feel overwhelming, yet recognizing flexible funding options is important for potential homeowners. A home funding, or mortgage, is a kind of financial debt that permits individuals to obtain cash to purchase a home, with the property itself serving as collateral.Key elements of home fundings consist of the primary quantity, rate of interest price, finance term, and month-to-month settlements.In verdict, browsing the landscape of home finances discloses many versatile financing choices that cater to diverse borrower needs. Understanding the intricacies of various loan types, Continue including government-backed fundings and adjustable-rate home loans, allows notified decision-making.